In the fast-paced world of Forex trading, automation is becoming an increasingly popular avenue for traders seeking efficiency and profitability. forex auto trading Islamic FX Trading facilitates a unique approach to Forex by embracing the principles of Sharia-compliant trading, enticing a new wave of traders to the markets. This article explores the fundamentals of Forex auto trading, the advantages it offers, and the risks involved.

Understanding Forex Auto Trading

Forex auto trading involves using automated software, known as trading robots or expert advisors, to execute trades on behalf of the trader. These programs analyze market conditions, identify trading signals, and execute orders based on pre-defined criteria without any human intervention. Auto trading allows traders to take advantage of market opportunities 24/7, which is essential in the highly liquid and time-sensitive Forex market.

How Auto Trading Works

At its core, Forex auto trading relies on algorithmic strategies driven by data inputs and market conditions. Traders develop or purchase algorithms that inform the trading software on how to react in specific situations—deciding when to enter or exit trades based on market signals. The effectiveness of these algorithms greatly influences the overall performance of automated trading systems.

Key Components of Auto Trading Systems

- Trading Strategy: This includes the rules and methods that govern how trades are executed. Strategies may vary widely, from trend-following to mean reversion, and can be coded into the system.

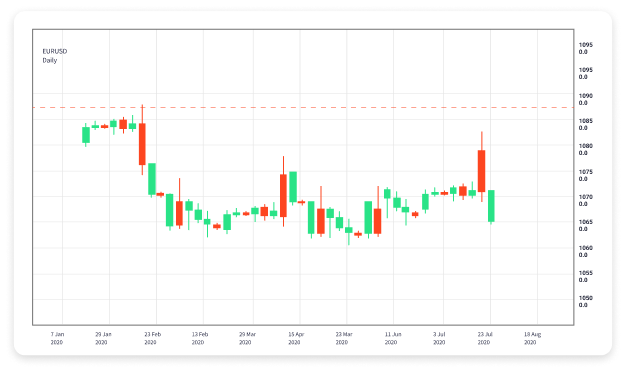

- Market Analysis: Auto trading systems analyze price action using technical indicators, economic news, or a combination of both to make informed trade decisions.

- Risk Management: Effective auto trading systems implement risk management protocols, such as stop-loss orders and position sizing, to protect traders from significant losses.

Benefits of Forex Auto Trading

The adoption of automated trading systems offers several advantages for both novice and experienced traders:

1. 24/7 Trading Capability

Forex markets are open around the clock, and manual trading can be demanding on a trader’s time and focus. Automated systems can monitor the markets continuously and execute trades even when the trader is away, enabling them to catch opportunities they might otherwise miss.

2. Eliminates Emotional Trading

Human emotions often lead to impulsive decisions that can negatively impact trading results. Automated trading systems operate based on algorithms, meaning that they can detach from emotional influences and make more objective trading decisions.

3. Backtesting and Optimization

One advantage of using an automated trading system is the ability to backtest strategies using historical data. Traders can refine their trading strategies through backtesting and optimization, ensuring they are robust and effective before deploying them in live markets.

4. Increased Efficiency

Automated systems can analyze vast amounts of data far quicker than humans can. This efficiency allows for better-informed trading decisions, faster execution times, and the ability to identify trends and signals that may go unnoticed by human traders.

Risks of Forex Auto Trading

While Forex auto trading offers numerous benefits, it is essential to be aware of its risks to make informed decisions:

1. Technical Failures

Like any software, automated trading systems are susceptible to technical issues, such as server outages or software bugs. Malfunctions can lead to unexpected losses, particularly if adequate risk management measures are not in place.

2. Over-Optimizing Strategies

Traders may be tempted to continually tweak their strategies based on past performance. However, over-optimization can lead to strategies that do not perform well in live markets due to overfitting, where a strategy is too finely tuned to historical data but fails to adapt to new conditions.

3. Market Risks

Forex trading is inherently risky, and automated systems are no exception. Market volatility can result in sudden price movements that automated systems may not react to effectively, which can lead to significant losses.

Choosing the Right Auto Trading System

Selecting an auto trading system involves careful consideration of several factors:

- Reputation: Look for reputable services and ensure they are transparent about their strategies and results.

- Performance: Review backtested performance and verify results through independent means.

- Support and Maintenance: Choose a provider that offers excellent support and keeps their software updated to handle changing market conditions.

Conclusion

Forex auto trading represents a transformative approach in the trading landscape, making it accessible to even those with limited experience. As the industry continues to evolve, integrating principles like those found in Islamic FX Trading can unlock further pathways for traders who wish to align their trading practices with their values. However, like any activity in the financial markets, it is essential to approach auto trading with a clear understanding of its benefits and risks, enabling informed decisions to be made in pursuit of trading success.